Taxes removed from paycheck

AB 194 chaptered on June 30 2022 conforms state tax law to the federal tax treatment for covered loan amounts forgiven pursuant to the PPP Extension Act of 2021. Roth conversions are more popular than ever after the income limits for making one were removed in 2010.

Irs Defers Employee Payroll Taxes Jones Day

This is the amount of an employees income left after required deductions such as taxes and Social Security contributions.

. Salary or hourly rate hours worked and the amount of pay for the period. These accounts all use pre-tax money which means that money goes into these accounts before taxes are removed. Now you can easily create a Form W-4 that reflects your planned tax withholding amount.

Obtained a PPP loan of 17 million by falsely certifying that GMP Cars had staff for whom it paid salaries and payroll taxes. By removing this money pre-tax you decrease how much of your paycheck is subject to taxes. In the Rate column enter the gross amount of the bonus.

Inevitably you may wish to undo a conversion perhaps due to poor investment performance. 45 of employees would feel more engaged with their job if their employer helped them better understand the impact of taxes and deductions Kronos. You can also shelter your money from taxes in a 401k or 403b retirement account where it will grow tax-free.

MUST be removed before printing. 1 after a monthlong moratorium. Additional Medicare Tax Withholding.

Submit proof of residency rental or mortgage agreement utility bill paycheck stub etc. Tennesseans may want to load up on groceries before Thursday to avoid paying state and local sales taxes on most food items which will resume Sept. Among other reforms the new law changed the tax rates and brackets increased the standard deduction removed personal exemptions and limited or discontinued certain deductions.

25 of employees cited a bigger paycheck as the top reason for quitting their job but 27 said the opportunity to do more meaningful work is why they accepted a new position. Due to legal requirements the following information cant be removed from a pay stub. Register a Used Vehicle.

However they are not typically considered pretax so theyre taken out of your paycheck based on the amount you make before the money is taxed. Earnings contributed to deductions not required by law such as contributions to a pension or life insurance policy still count as part of your gross income even if theyre removed directly from your paycheck. 2021 2022 Paycheck and W-4 Check Calculator.

In the Earnings box of the Preview Paycheck window select in the Item Name column to get a drop-down menu select a bonus item. In addition to withholding Medicare tax at 145 you must withhold a 09 Additional Medicare Tax from wages you pay to an employee in excess of 200000 in a calendar year. A list of PPP fraud cases under the Paycheck Protection Program.

Overview of Georgia Taxes Georgia has a progressive income tax system with six tax brackets that range from 100 up to 575. All earnings items and information besides the bonus item should be removed from the paycheck detail as needed. We removed existing instructions.

Pay all the applicable fees and taxes. The TN Department of Revenue provides lists of acceptable identity and residency documents for you to reference. The bill made the new business facility employee tax credit available to the business where the employee worked even if an employee leasing company withheld the taxes from that employees paycheck.

That 250 would be pulled for your insurance payment and youd pay taxes. For example lets say your employer-sponsored health insurance costs 250 each month and you earn 4500 each month. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

At your local county clerks office provide. But according to the criminal complaint Palermo used company funds for lavish personal expenses including a Ferrari racing car leaving the business. Standard font size or Large font size.

2008 Senate Bill 08-107 The bill removed the requirement that the state auditor has to perform an audit every five years. The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and integrated W-4 calculator tool for you. The type and rule above prints on all proofs including departmental reproduction proofs.

Instructions Page 2 column 1 Sales and Use Taxes Section 2nd paragraph. For tax years before 2018 you have until October 15th of the year after making a conversion to reverse it and avoid the related tax liability. Under Important Information last paragraph and.

The Tax Cuts and Jobs Act enacted in December 2017 changed the way tax is calculated for most taxpayers including retirees. Due to legal requirements salary hours cannot be removed from pay stubs.

Different Types Of Payroll Deductions Gusto

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

How To Take Taxes Out Of Your Employees Paychecks With Pictures

Part 2 Salary Vs Actual Pay An Actual Paycheck In California Fashionfoodiela

How To Withhold Payroll Taxes For Your Small Business

Understanding Your Paycheck Credit Com

Paycheck Taxes Federal State Local Withholding H R Block

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

Understanding Your Paycheck

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora

Here S How Much Money You Take Home From A 75 000 Salary

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora

What Are Payroll Deductions Article

Understanding Your W 2 Controller S Office

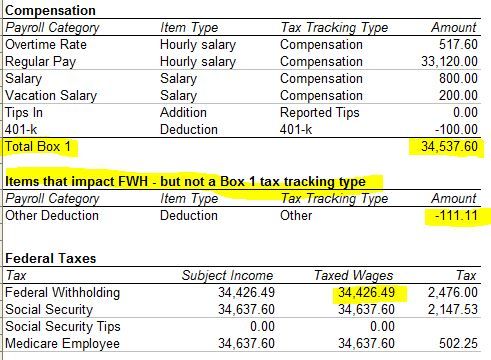

Solved W2 Box 1 Not Calculating Correctly

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time